The Economist: After urogeddon? 17 Frequently Asked Questions about the break-up of the euro zone

Economiewoensdag, 19 oktober 2011 om 00:00

Nu het crisis is moet je The Economist lezen (als het geen crisis is trouwens ook, of The best off hier op Welingelicht). Dan zou je hebben gezien dat The Economist Intelligence Unit een vraagbaak over de ineenstorting van de euro heeft. Zodat je bent voorbereid. We doen hier alle vragen en 2 antwoorden. Als je alle antwoorden wilt, moet je de link volgen en een download aanvragen.

1. Can a country leave the euro? 2. What would be the likely trigger for a country leaving the euro? 3. Could a country default and stay within the euro? 4. Would an exit by one country (such as Greece) cause others to leave the euro? 5. Which countries would be most likely to stay in the euro, and which would be most likely to leave? 6. What would be the immediate economic and financial consequences for countries leaving the euro? 7. And for the countries that stayed? 8. What would be the impact on global financial markets? 9. What would be the impact on the euro in relation to global currencies? 10. Would a global recession be inevitable if the euro collapsed? 11. What would happen to banks in countries that left the euro? 12. Could private debt in euros be enforced? 13. What would happen to sovereign debt? 14. Could EU internal market rules be maintained? 15. Would countries that exited the euro remain in the EU? 16. What levels of social and political upheaval would be expected? 17. What should businesses do now? 1. Can a country leave the euro? Technically, no. However, we assume that under extreme circumstances, procedural and legal obstacles would not prevent an exit. No formal mechanism exists for a country to be expelled from the euro area or to leave of its own volition, and a comprehensively negotiated exit—if even possible—could take years. Instead, a country might leave unilaterally, breaching many of its legal obligations to the EU, its creditors and others. In this messy scenario, uncertainty in the interim over a country’s formal membership status would quickly become secondary to its de facto status as a pariah. Alternatively, a stricken country could in effect be expelled if policy institutions and fellow euro members decided to withhold financial support, thus pushing the country towards a position in which it felt unilateral exit was its best choice. The practical challenge of switching rapidly to a new currency—countries had years to prepare for the introduction of the euro—would also be formidable. Back to top 2. What would be the likely trigger for a country leaving the euro? It is conceivable but highly unlikely that Germany or another fiscally and economically strong country might decide to leave the euro. The more likely eventuality, which we examine here, is that of a weak economy such as Greece leaving. The most likely initial trigger would be a disorderly sovereign default. This could happen if the country refused to accept harsh terms for financial support; or if euro institutions, the IMF and other euro members declined to intervene further on the grounds that the country was failing to implement effective deficit-cutting measures. The former is most likely. Default would wreak havoc in the domestic banking system because of banks’ sovereign debt exposure. In fear of bank failures, panic withdrawal of funds could follow. Unless countered by the provision of sufficient liquidity from the European Central Bank (ECB), this would in effect lead to the collapse of the banking system, making normal commercial life impossible. At this point, the only way to restart commercial activity could be to introduce a new national currency.

En als het niet lukt met aanvragen: mail naar [email protected] en we sturen het toe

Bron(nen): EIU

POPULAIR NIEUWS

Welke hondenrassen leven het langst? Welke zijn het gezondst?

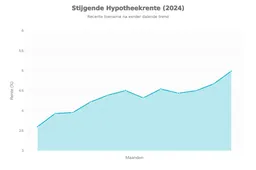

Waarom gaat de hypotheekrente weer omhoog

Nieuw soort tandpasta blokkeert bacterie die tandvlees sloopt

Dit ene knopje kan je redden als je vastzit in de sneeuw en andere rijtips

Waarom Amerika niet zonder Europa kan

Als je vlucht niet gaat: 9 dingen die altijd in je koffer moeten

Loading